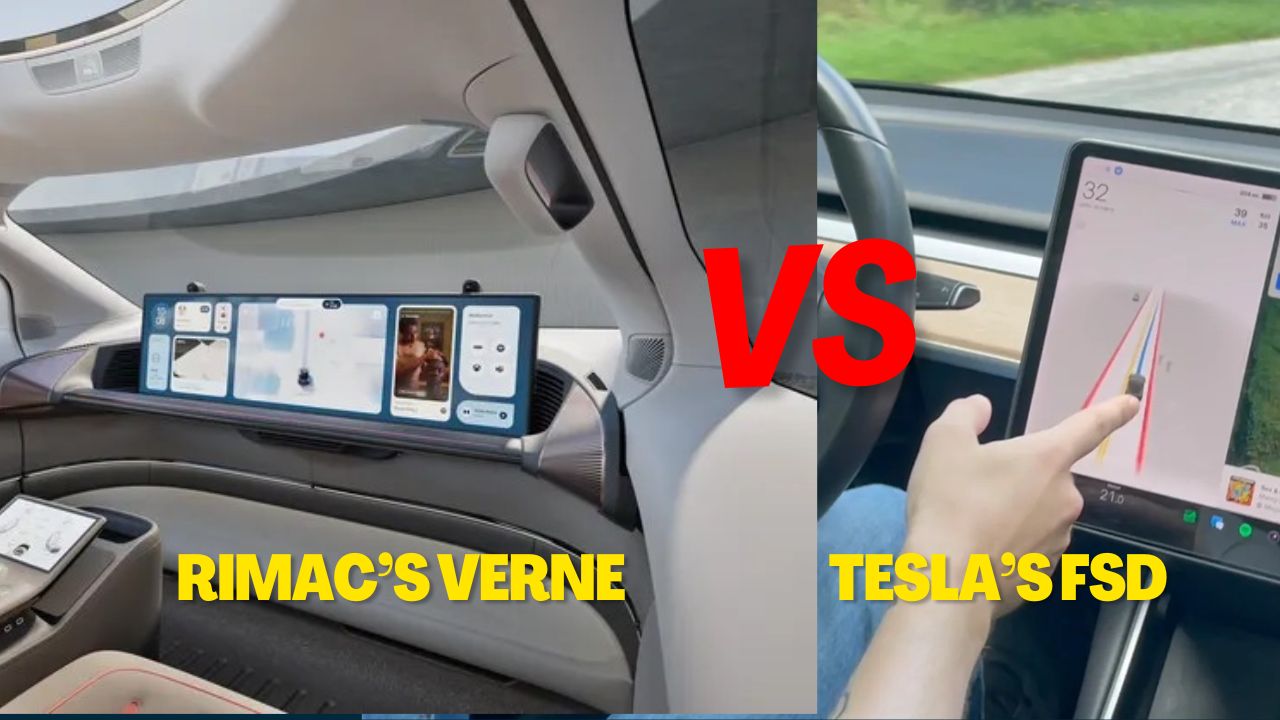

In a surprising pivot, Rimac, the Croatian electric hypercar manufacturer, is gearing up to enter the robotaxi market with its newly announced “Verne” autonomous vehicle service. Set to debut in Zagreb, Croatia in 2026, this move marks a significant shift for the company known for its record-breaking Nevera model. But can Rimac, a relative newcomer to the autonomous driving scene, truly challenge Tesla’s Full Self-Driving (FSD) technology?

From Garage to Global Player

Founded by Mate Rimac in 2009, Rimac’s journey from a garage startup to a key player in the electric vehicle industry reads like a modern tech fairy tale. Initially focused on high-performance electric supercars, the company has since diversified into supplying electric powertrain components to major automakers like Porsche, Hyundai, and Kia.

In 2021, Rimac formed a joint venture with Volkswagen-owned Bugatti, creating Bugatti Rimac, with Rimac holding a 55% stake. This move solidified Rimac’s position in the luxury electric vehicle market and demonstrated its ability to attract heavyweight partners.

The Verne Robotaxi: A New Direction

The Verne robotaxi represents a dramatic shift for Rimac. According to The Verge, the vehicle is a sleek two-seater hatchback designed to offer a luxury experience in a compact package. Key features include:

- Level 4 fully autonomous driving capability

- A 43-inch display for media controls, navigation, and entertainment

- Customizable settings for temperature, lighting, and even scent

- “Mothership” depots for cleaning, charging, and maintenance

Rimac plans to expand the Verne service to other European cities, including the UK and Germany, followed by the Middle East.

Challenging Tesla: David vs. Goliath?

While Rimac’s entry into the robotaxi market is ambitious, it faces significant challenges in competing with Tesla’s established FSD technology:

- Data Advantage: Tesla has over a million vehicles on the road collecting real-world driving data, giving it a substantial edge in training its autonomous systems.

- Technological Approach: Tesla relies primarily on cameras for its FSD system, while Rimac’s Verne will use Mobileye’s technology, which incorporates a broader sensor suite.

- Market Presence: Tesla’s FSD is already operational in the US (not as robotaxis), albeit with limitations, while Rimac is yet to launch its first robotaxi or any test vehicle.

- Regulatory Experience: Tesla has navigated complex regulatory environments for years, while Rimac will need to quickly build this expertise.

However, Rimac’s partnership with Mobileye, a leader in autonomous driving technology, could provide a significant boost. Mobileye’s experience and proven track record may help Rimac overcome some of the technological and regulatory hurdles more quickly than if it were developing the technology entirely in-house.

Here’s a comparison of key technology and data aspects between Tesla and Mobileye (Rimac’s partner):

| Metric | Tesla | Mobileye (Rimac) |

|---|---|---|

| Fleet Size | Over 1 million vehicles with Autopilot/FSD hardware | Not publicly disclosed, but likely smaller than Tesla’s fleet |

| Driving Data Collected | Over 3 billion miles as of 2020 | Not publicly disclosed, but likely less than Tesla’s data |

| Simulation Data | Tens of billions of miles in computer simulations | Extensive simulation data, leveraging Mobileye’s experience |

| Sensor Suite | Primarily camera-based, no lidar | Camera-based system with Mobileye’s proven autonomous driving technology |

| Compute Hardware | Custom Tesla-designed self-driving computer chip | Leverages Mobileye’s expertise in autonomous driving hardware |

| Approach | Train neural networks on real-world driving data from Tesla fleet | Combine Mobileye’s proven autonomous driving algorithms with Rimac’s vehicle expertise |

| Regulatory Approval | Facing challenges in some markets due to safety concerns | Mobileye has extensive experience navigating regulatory environments globally |

| Autonomy Level | Currently at SAE Level 2, aiming for Level 5 autonomy | Targeting SAE Level 4 autonomy for the Verne robotaxi |

The Future of Rimac’s Supercar Business

Despite the shift towards robotaxis, Rimac is expected to continue producing high-performance electric supercars. The company’s expertise in electric powertrains and autonomous systems, gained through its supercar development, will likely provide advantages as it enters the robotaxi market. The Verge reports that Rimac’s diverse range of products and services is expanding with the robotaxi service, suggesting that the company aims to maintain its position in both the luxury electric vehicle and autonomous mobility markets.

Challenges in Transitioning to Robotaxis

Rimac faces several challenges as it transitions into the robotaxi market. These include navigating complex regulatory landscapes across different cities and countries, overcoming technological hurdles in developing safe and reliable autonomous systems, and competing with established players like Waymo and Cruise. Motorauthority notes that some promising robotaxi companies have already backed out due to these difficulties. Rimac will need to carefully balance its investments between its supercar and autonomous mobility segments to ensure success in both areas.

Impact on Existing Partnerships

The development of robotaxis is not expected to significantly impact Rimac’s existing partnerships with other automakers in the near term. The Bugatti Rimac joint venture appears to be proceeding as planned, with Rimac holding a 55% stake. However, reports suggest that Rimac’s partnership with Hyundai may be uncertain due to Rimac’s closer ties with Porsche. Nonetheless, Rimac seems committed to maintaining these relationships as it diversifies into the robotaxi market, leveraging its expertise across multiple automotive sectors.

The Road Ahead

Rimac’s transition from supercars to robotaxis is bold and risky. The company will need to carefully balance its resources between its high-performance vehicle business and the new robotaxi venture. Marko Pejković, CEO of the Verne project, and Adriano Mudri, chief designer, will be key figures in navigating this transition.

While it’s premature to declare Rimac a serious threat to Tesla’s FSD ambitions, the Croatian company’s innovative approach and strategic partnerships make it a player to watch in the evolving autonomous vehicle market. As the race for fully autonomous transportation heats up, Rimac’s Verne project adds an intriguing new contender to the field.