In a significant move that could reshape the global automotive landscape, Honda and Nissan have entered advanced merger talks aimed at creating the world’s third-largest automaker by 2026. The proposed merger, valued at approximately $50 billion, comes as both Japanese automakers face mounting pressure from Chinese competitors and the industry-wide transition to electric vehicles (EVs).

The merger discussions gained momentum after Nissan’s recent financial challenges, including a quarterly loss of 9.3 billion yen (US$61 million) and a credit outlook downgrade to ‘negative’ by Fitch Ratings. These difficulties have led Nissan to announce a 20% reduction in production capacity and the planned layoff of 9,000 workers.

During a roundtable discussion at CES in Las Vegas, Honda executives provided additional context for the merger. Honda CEO Toshihiro Mibe expressed concerns about the rise of Chinese automakers, stating that “we have to build up capabilities to fight with them by 2030, otherwise we’ll be beaten.”

The combined entity would bring together significant manufacturing capabilities:

• Combined sales volume: 7.35 million vehicles (2023)

• Honda’s US presence: 12 facilities producing 3.5 million products annually

• Nissan’s US footprint: 2 vehicle assembly plants and 1 powertrain factory

The merger talks have been partially influenced by Japan’s Ministry of Economy, Trade, and Industry (METI), which has encouraged the consolidation to maintain the stability of Japan’s automotive sector. This comes after reports that Taiwan’s Foxconn had expressed interest in acquiring Nissan, adding urgency to the negotiations.

The deal’s complexity is heightened by existing partnerships. Renault, which holds a 36% stake in Nissan, has indicated willingness to reduce its shareholding, potentially selling a portion to Honda. Additionally, Mitsubishi Motors, currently part of the Renault-Nissan-Mitsubishi Alliance, is expected to decide by January 2025 whether to join the merged entity.

The proposed timeline includes completing a definitive agreement by June 2025, followed by shareholder votes in April 2026. If approved, the new holding company would be listed on the Tokyo Stock Exchange by late July or early August 2026, replacing the individual listings of Honda and Nissan.

However, the merger faces criticism from industry veterans. Former Nissan CEO Carlos Ghosn, who was arrested in 2018 on fraud charges, has characterized the move as “desperate” and questioned the potential synergies between the companies. This skepticism stems from the aftermath of his arrest, which contributed to Nissan’s current financial instability.

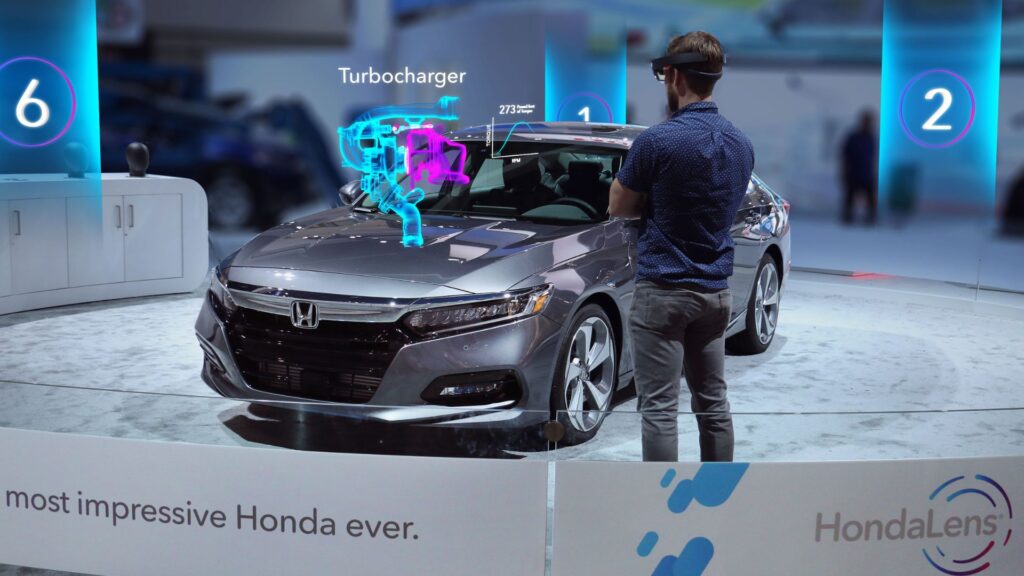

Honda executives have identified specific benefits in the merger, particularly access to Nissan’s larger SUV lineup and Nissan’s available manufacturing infrastructure. Honda’s current US operations are running at maximum capacity, making Nissan’s available manufacturing infrastructure particularly attractive for meeting customer demand.

The merger also represents a strategic response to evolving market dynamics, with global EV sales expected to grow by 30% year over year, reaching 89.6 million units in 2025. The autonomous vehicle market is similarly projected to expand from $60.3 billion in 2025 to $448.6 billion by 2035, underscoring the importance of combined resources for future technology development.