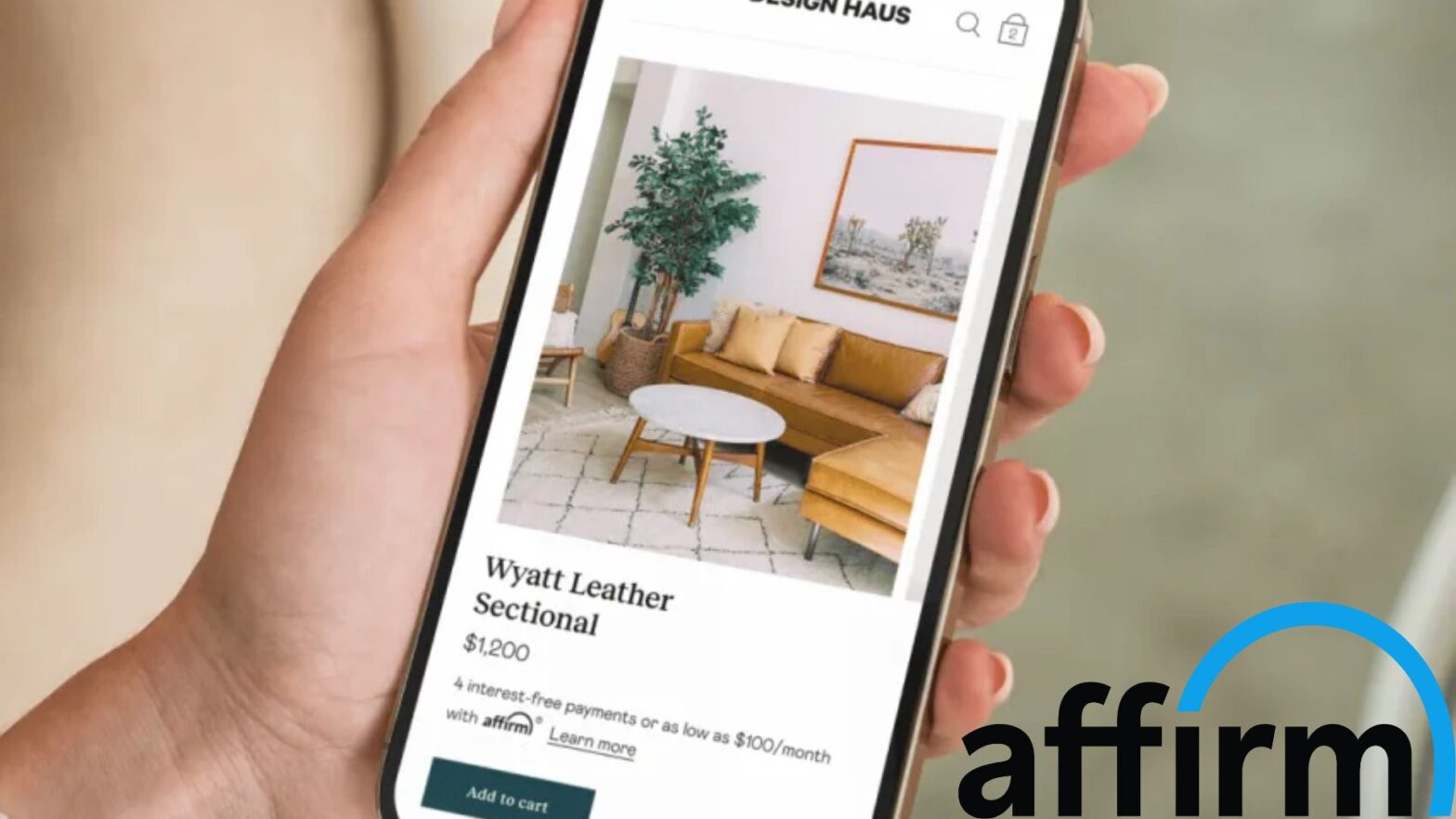

[LONDON, November 4, 2024] – U.S. fintech giant Affirm has officially launched its “buy now, pay later” (BNPL) services in the United Kingdom, marking the company’s first international expansion. While the move signals Affirm’s ambitions to capture a share of the rapidly growing BNPL market, the company faces several key challenges as it navigates the UK’s evolving regulatory landscape.

The BNPL industry has seen explosive growth in recent years, driven by consumers’ appetite for flexible payment options, particularly during the COVID-19 pandemic when online shopping surged. However, this rapid expansion has raised concerns about consumer debt and financial health, prompting the UK government to announce plans to regulate the sector.

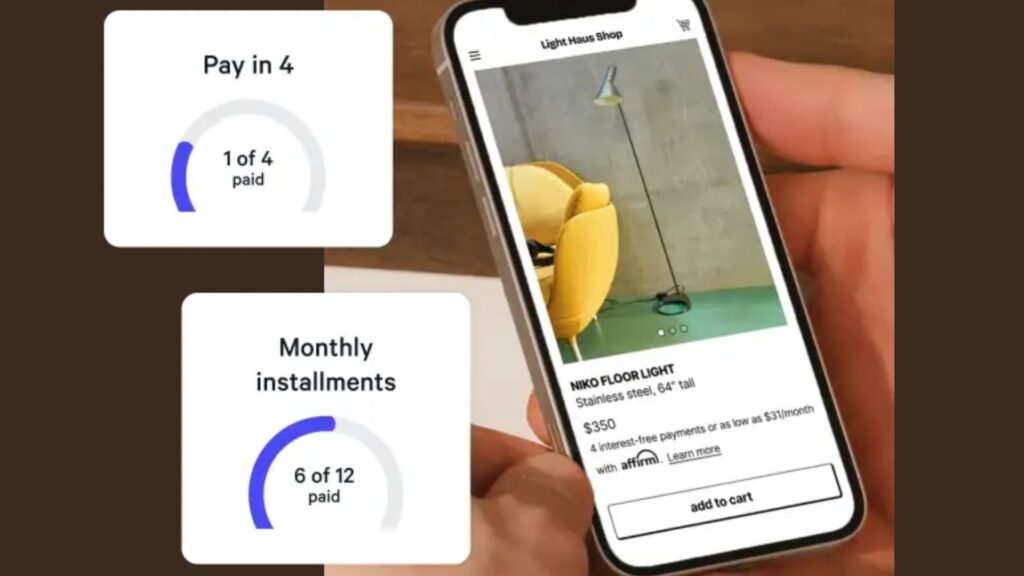

Affirm’s entry into the UK market comes as the government prepares to bring BNPL providers under the same regulatory framework as traditional credit providers. These upcoming changes, set to take effect in 2026, aim to enhance consumer protection and ensure responsible lending practices.

- Differentiating from Established Competitors: Affirm will need to carve out a distinct niche in a crowded UK BNPL market dominated by players like Klarna and Clearpay. While Affirm’s focus on transparency and its lack of late fees may appeal to some consumers, the company will have to carefully position its offerings to stand out from its rivals.

- Adapting to Regulatory Oversight: With the Financial Conduct Authority (FCA) set to oversee BNPL providers, Affirm will need to ensure its business model and operations comply with the upcoming regulations. This includes meeting requirements for creditworthiness assessments, pre-contractual disclosures, and consumer rights protections. Navigating this shifting landscape will be crucial for Affirm’s long-term success in the UK.

- Fostering Trust and Transparency: The BNPL industry has faced criticism for allegedly “normalizing debt” and encouraging impulse purchases. Affirm will need to actively promote its commitment to responsible lending and transparency to build trust with both consumers and regulators. This could involve enhancing pre-purchase information, streamlining the application process, and maintaining clear communication about payment terms.

- Addressing Consumer Concerns: As the UK market braces for tighter regulations, Affirm will need to address common consumer complaints associated with BNPL services, such as late fees, hidden charges, and unaffordable borrowing. Demonstrating a genuine focus on consumer protection and financial wellbeing will be crucial for Affirm to differentiate itself and gain widespread adoption.

- Navigating the Temporary Permissions Regime: During the transitional period before full FCA authorization, Affirm will operate under the UK’s Temporary Permissions Regime (TPR). This will require the company to carefully manage its operations and communications to ensure a smooth transition into the new regulatory framework. Missteps could jeopardize Affirm’s ability to maintain a presence in the UK market.

As Affirm embarks on its UK expansion, the company must navigate a complex web of competitive, regulatory, and consumer-centric challenges. Its success will depend on its ability to adapt its model, foster trust, and demonstrate a genuine commitment to responsible financial innovation.

“Affirm is committed to responsible lending practices and welcomes thoughtful regulation that protects consumers without stifling innovation,” said Max Levchin, CEO of Affirm. “We believe our transparent approach and lack of hidden fees will resonate with UK consumers looking for a more trustworthy BNPL option.”

With the UK government’s regulatory overhaul looming, all eyes will be on Affirm as it strives to carve out a prominent position in the rapidly evolving BNPL landscape.